In business, people must plan and organize the receipts used for taxation. The receipts have been in use since 7500BC. These receipts were made in clay balls and covered complete transactions. Currently, people use the digital and paper receipts, used later to compile taxes. You must keep these receipts safely and retrieve them during the tax season. You can log into this website to learn more details.

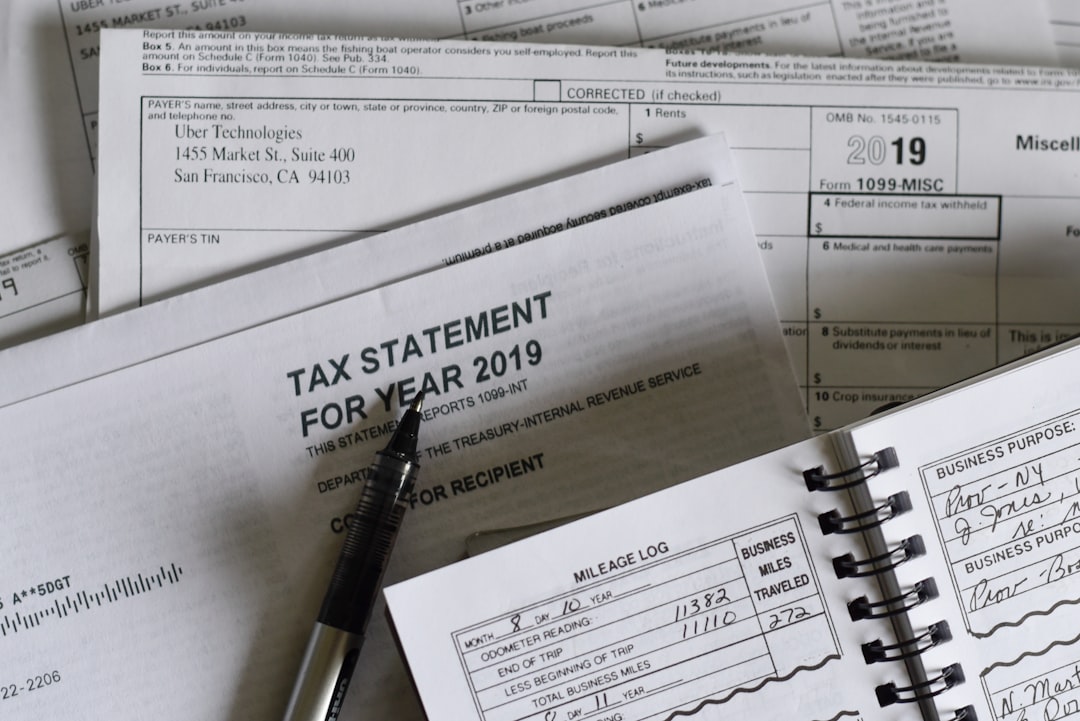

It is hard to keep check of daily expenses, but this is needed. Use a system to do this and avoid the rush later. Have the check-in periods to avoid trouble. This means taking some time off to keep the receipts in order, as shown here!

People who set this time develop the habit of storing their receipt in the right order. Organize tour expenses by use of color folders. Have a single folder in the desktop to keep digital receipts. During the deadlines, use your organizational system chosen. Visit this website and find the details.

A person filing their tax will check various payments as shown here.

There are home expenses like repairs, monthly bills like phone, water, and renovation expenditure.

Your receipts will also show the car expenses. These involve regular maintenance, repairs, gas, license renewal, car rental registration, and miles covered.

Record the money spent in schools such as tuition and book purchase fees.

People spend on medication such as buying health insurance for loved ones.

As shown in this site, people spend cash when moving, donating to charity, and paying business usage.

During tax seasons, employers and employers go for pay stubs as shown now! An employee deals with IRS to ensure payment of withholding tax based on earnings. You can read more here to get the right details.

The pay stubs remain crucial for employers who use them to keep records. The employer provides the payment details mined from the pay stub. You can learn more about how to create a pay stub by using the free paystub generator.

A person might have a good organizational system and all receipts. Individuals still need to employ some backup measures. You still need to scan the documents and keep a backup in your mail inbox.

You are not forced to be elaborate when doing this job. You can have a simple backup to ensure you are safe. You can click here to know how to stay safe.

A person will discover more on ways to organize their receipts for taxes by visiting this homepage. If you use the color-coded folders or scan the receipts, it becomes easier to file the returns.